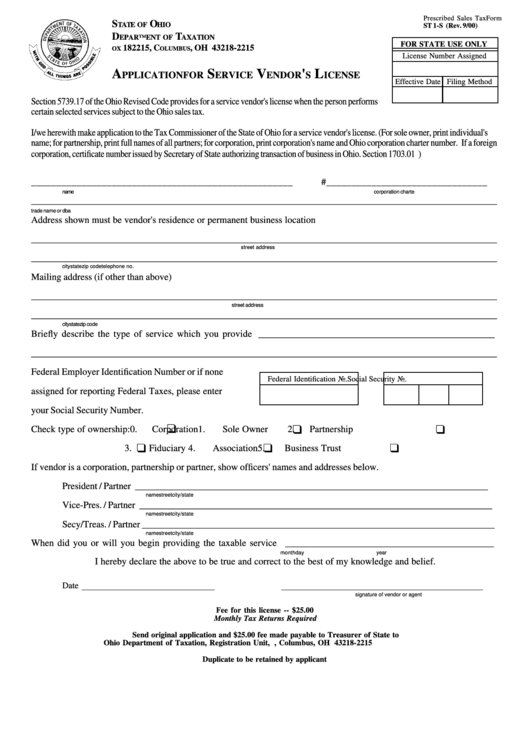

Application fee of $25.00 – No Annual Renewal Vendors must have one regular vendor license for each sales location. Issued by the County Auditor to vendors with a fixed place of business in Ohio. 508 amended Ohio Revised Code 5739.17to reduce the types of vendor’s licenses to regular county and transient. Call the State of Ohio Department of Taxation to cancel the old Vendor's License at 1-88. Helpful InformationĮvery Ohio retailer (vendor) making taxable retail sales must obtain a vendor’s license, collect sales tax, file tax returns with payment of tax collected and maintain complete records of transactions.Įffective SeptemH.B. If you move your business to another county, contact the County Auditor in the new county to purchase a new Vendor’s License. If a vendor wishes to move an existing fixed place of business to a new location within the same county, the vendor shall obtain a new vendor's license or submit a request to the State of Ohio, Department of Taxation to transfer the existing vendor's license to the new location. If you need a duplicate copy of your current Vendor’s License you may get a copy from the Lucas County Auditor’s Office in person or by mail.Ī Transient Vendor’s License is a one-time $25.00 fee. It will not expire as long as you are reporting taxable sales. By Mail: (Enclose Completed Application & $25.00 Fee)Īpplication for Transient Vendor’s License to Make Taxable Sales (PDF)Ī County Vendor’s License is a one-time $25.00 fee. Please see the FAQ section to decide which license is necessary for your business.Īpplication for Vendor’s License to Make Taxable Sales (PDF)Ģ.

Contact the Lucas County Auditor’s Office at 41 or State of Ohio, Department of Taxation at 1-88 with questions regarding County or Transient Vendor’s License.Įvery Ohio retailer (vendor) and certain service providers making taxable retail sales must obtain a vendor’s license, collect the proper amount of sales tax, file tax returns with payment of the tax collected, and maintain complete records of transactions.

0 kommentar(er)

0 kommentar(er)